Author: Meg Dimmick

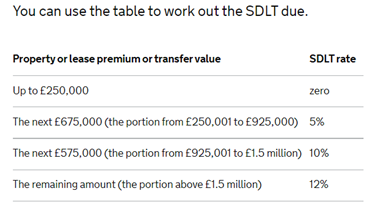

Stamp duty land tax (SDLT) reduced rates will apply for residential properties for a limited period stipulated by HMRC.

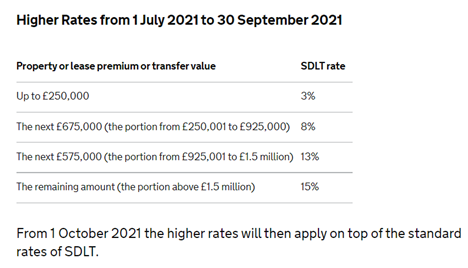

As of 1st July 2021, and up until 30th September 2021, the nil rate band will be £ 250 000.

As of 1st October 2021, the nil rate bank will resume the standard amount of £ 125 000.

The rate of SDLT which applies to your residential property purchase depends on the date that you complete your property purchase and not the date you exchanged contracts.

Stamp duty holiday – for individuals – only home purchased (residential property)

Stamp duty holiday – for companies and individuals purchasing second properties (residential property)

For any guidance and tax planning as to whether to purchase a property as an individual or through your limited company, or assistance in the calculation of your SDLT due on a purchase, please don’t hesitate to contact our offices info@sailsolutions.co.uk