The SA Budget Speech 2023 discussed the country’s economy, growth estimates, taxation, and social wages.

The annual National Budget Speech was held on the 22nd February 2023, in which, South African Finance Minister, Enoch Godongwana, discussed the state of the country’s economy, including growth estimates, taxation proposals and social wages. He particularly focused on the ongoing energy crisis and its impact upon the South African economy and undeniably, it can be seen as an impediment to economic development in South Africa.

The Finance Minister made it clear that government is determined to find solutions for South Africa’s energy crisis.

Here are some of the highlights:

- 7 billion more than initially projected was collected in tax revenue for 2022.

- The National Treasury predicts a GDP growth rate of 0.9% for 2023 (although note this is higher than the Reserve Bank’s forecast of 0.3%.

In a statement, Treasury announced a debt-relief package of R254 billion for Eskom, to be delivered in two parts.

- R184 billion will be paid out over three instalments in order to fully settle Eskom’s debt requirements.

- Secondly, R70 billion will be taken on directly by Treasury in 2025/26 as part of its loan portfolio takeover.

This arrangement is however subject to certain conditions in order to ensure that public funds are safeguarded.

Renewable Energy Incentives in the SA Budget Speech 2023

The Minister announced two new tax incentives to promote investment in renewable energy and bolster electricity generation, ultimately with the intention to reduce pressure on the country’s electricity grid.

Business Solar Relief

Under this scheme, businesses will be able to claim up to 125% of their expenditure on renewables.

Individual’s Solar Relief

Additionally, individuals who install rooftop solar panels are eligible for a rebate of 25% of its cost, but capped at R15 000. This will only be valid for one year and must be purchased after 1 March 2023 and can be used to reduce an individual’s tax liability in 2023/24.

Furthermore, from April 2023, small and medium enterprises will have access to solar-related loans through the Energy Bounce Back Scheme with a first-loss guarantee of 20%.

South African taxpayers can be thankful that there will be no major tax changes. However, adjustments in line with inflation will take effect from the beginning of the 2024 tax year.

Transfer Duty

A 10% increase in transfer duties, allowing properties below R1.1 million to avoid any transfer duty payments.

The research and development tax incentive will be extended for 10 years, and it is intended this will be refined to make it simpler and more effective.

The urban development zone tax incentive will also be extended, by two years, to allow for the review of the incentive to be completed.

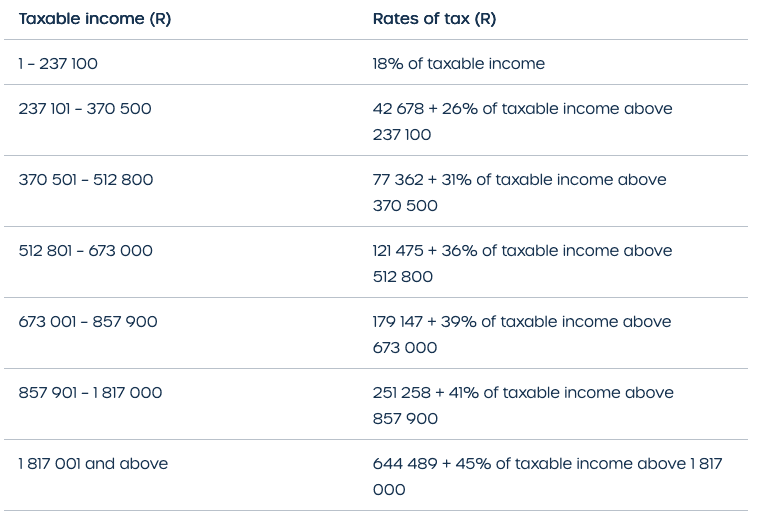

Personal Income Tax

Personal income tax brackets will be adjusted to account for inflation, raising the tax-free threshold from ZAR 91 250 to ZAR 95 750.

Road Accident Fund Levy

In an effort promote investments in renewable energy sources, the government has taken steps such as not increasing the general fuel levy or Road Accident Fund levy this year.

Retirement & Pension

An upwards adjustment of 10% in retirement fund lump sum benefits and withdrawal benefits. Additionally, the amount that can be withdrawn tax-free at retirement will rise up R550 000.

Government will also be publishing a revised draft of the legislation for a new “two-pot” system relating to allowing access to your pension in an emergency, that is set for implementation from 1 March 2024.

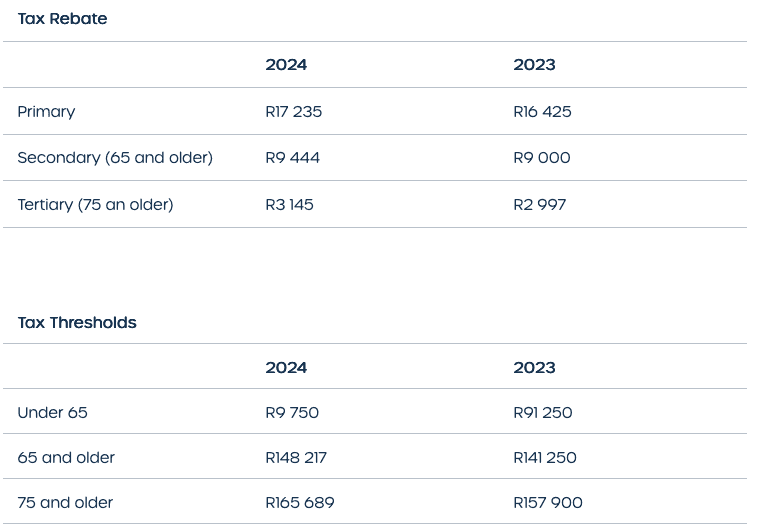

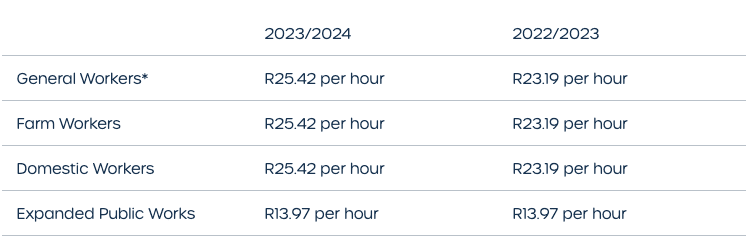

Medical Tax Credits

Medical tax credits will be adjusted by inflation.

Travel Allowance

In order to assess expenses that can be claimed against a travel allowance, both the actual distance travelled during the tax year and any business-related travel logged in a logbook are taken into account. However, when actual costs cannot be determined, rates per km are used as an allowable deduction against an allowance or advance. The new prescribed rate is R4,64 per kilometre form 1 March 2023.

Subsistence Allowance

Employees who spend at least one night away from their normal residence for business purposes are eligible to receive a subsistence allowance. For those staying within South Africa, there is a daily amount of R161 for incidental costs only and R522 for meals and related costs. For employees residing outside of South Africa, rates may vary depending on which country they are in; SARS’ country table

Lastly, where no overnight stay has been made but with specific approval from their employer, a maximum subsistence allowance of R161 (with proof of expenses) will become available as of 1 March 2023.

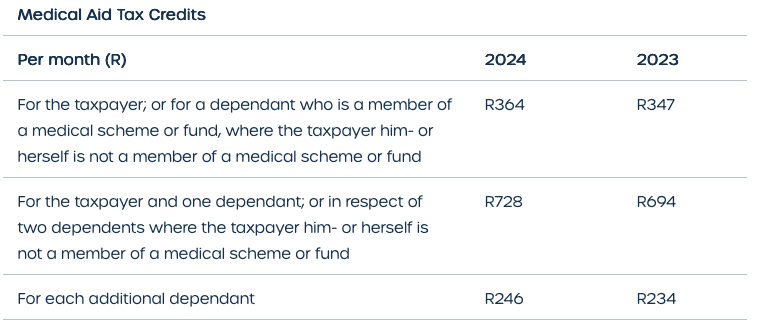

National Minimum Wage

National Minimum Wage will now increase to the following:

Some sectors have specific minimum wages and each industry should be checked individually.

Grants Set Aside in the SA Budget Speech 2023

For 2023, R66 billion has been allocated to South Africa’s Department of Social Development. A large portion of this sum, amounting to R36 billion, is intended for an extension of Social Relief of Distress (SRD) grants until March 2024. This grant was introduced as a temporary measure during Covid-19 and will provide much needed relief to those in need.

Additionally, R30 billion has been set aside for inflation-linked increases to other existing grants such as old age, disability and childhood support grants.

- Grant-in-aid rises to R505, up by 5.2%

- Child support grants go up by 5.2% to R505

- Care dependency grants rise to R2,085 from R1 985

- The foster care grant increases by 5.1%

- Disability grants increase to R2 085

- Grants for war veterans increase from R2 005 to R2 105

- The old age grant will go up from R1 985 to R2 085 (The old age grant for those over the age of 75 will increase to R2 105)

Sin Tax

The 2023 budget saw no change to the health promotion levy, otherwise known as the “sugar tax”, despite the sugar industry’s difficulty in staying afloat. On the other hand, beer and other alcoholic beverages were not so lucky; an increase of 4.9% was proposed for their associated excise duties – matching the expected inflation rate.

- 10 cents more on a 340-millilitre can of beer

- 18 cents more on a 750-millilitre bottle of wine

- R3.90 increase on a 750-millilitre bottle of spirits

- R5.47 up for a 23-gram cigar by R5.47

- 98 cents more on a pack of 20 cigarettes

If you have any questions about how the SA Budget Speech 2023 will affect you, please contact SAIL.