Author: Erin Snyman

In a bid to support the hospitality sector HMRC has cut the VAT rate from 20% to 5%, the rate cut will take effect from 15 July 2020 to 12 January 2021.

The reduced rate applies to the following industries:

Hospitality

Restaurants, cafés, and pubs can take advantage of this rate cut if they supply food and non-alcoholic drinks for consumption at their premises. The rate cut is also extended where hot take-away food and hot non-alcoholic drinks are supplied.

It is important to note that food and drinks supplied as a catering service for consumption off-site will remain at the standard rate.

HMRC has issued guidance on catering and take away foods and gives further details on to how to treat specific items. It is advisable if you are in the catering and or take away industry to read this notice. (VAT Notice 709/1)

Hotel and holiday accommodation

Those supplying accommodation in a hotel, inn, boarding or similar establishment, charging fees for caravan pitches, tents pitches and who charge camping fees will benefit from the reduced rate.

HMRC already allows for a reduced rate when a guest stays for over 28 consecutive days. It is important to understand that the reduced value rule for long stay guests operates differently from the temporary reduced rate for VAT. The long stay guests rule operates to relieve part of the charge for the supply from VAT as opposed to reducing the rate of VAT charged.

For further details, guidance and examples please read the following HMRC VAT guidance notice. (VAT Notice 709/3)

Admission to certain attractions

Businesses that make supply of admissions that currently charge the standard rate will qualify for the reduced VAT rate. Supplies which are exempt will take precedence and businesses will not charge the reduced rate.

Where goods are included in the admission fee and are related to the main supply then the whole supply can take advantage of the reduced rate. The reduced rate does not apply to any admissions for sporting events.

Further guidance for VAT on admissions fees can be found here. VAT Guidance

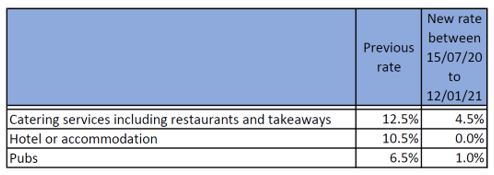

HMRC have reduced the percentages for the Flat rate VAT scheme in line with the temporarily reduced rate cut.

It will be interesting to see if these sectors offer reduced prices to consumers or take the benefit of the VAT reduction for themselves. Some businesses have already indicated they will pass on the reduction to consumers whilst others may choose to use the saving internally to recover from the lockdown period.

Businesses affected by these rates cuts should ensure that all internal systems and processes are up to date to ensure correct reporting to HMRC on VAT returns.