Author: Gina Christodoulou

It might be a new year, but the ongoing Covid-19 pandemic means that there are further challenges for the retail industry to come in 2021.

With the UK’s third lockdown once again forcing retail stores to close, we look at the changing landscape for how retailers are faring and discuss the business support available to them.

How can retail businesses continue selling goods when not physically present in store?

A shift to online retail. SAIL can assist you to set up ecommerce arrangements through your business website using XERO and an e-commerce platform to accept payments and manage your stock control.

Even if your customers cannot purchase directly from you online, retailers should think about having a strong social media presence and running data-driven digital advertising campaigns – potentially partnering with third party retailers on campaigns to enable data exchange. It may also be worthwhile looking at augmented reality technologies to give customers a better shopping experience.

So, what about brick-and-mortar retail?

What the in-store experience will look like remains unclear, however an alignment of the in-store and online experience will be key for retailers in ensuring that sales remain stable, particularly as consumers might be reluctant to return.

It will be important to provide customers with flexibility and convenience. This could be offering services like click and collect or providing customers with product recommendations based on both online and in-store browsing.

ICAEW wrote “There will be fewer high street stores in future. The ones that remain will be showrooms, displaying limited stock. The in-store experience will, therefore, be more important than ever going forward. Pre-COVID, Perfume brand Jo Malone offered complimentary in-store hand and arm massages. Lego stores continue to provide 3D ‘test drives’ of Lego sets.”

Business support

In the UK Spring Budget, the Chancellor, Rishi Sunak, announced further support for the struggling high street, including a business rates holiday extension and a new ‘restart’ grant scheme.

What are Business Rates?

Business rates are a tax paid by UK businesses on the property they occupy. The tax is based on an estimate of the rentable value of the premises, as calculated by the Valuations Office Agency.

Properties are exempt if used for: worship, agriculture, or the training or welfare of disabled people. Certain other uses/categories of property qualify for full or partial rates like empty properties (for a minimum period) and exempted buildings. The smallest businesses can also qualify for .

How have businesses who pay Business Rates been impacted during the pandemic?

The Institute of Chartered Accountants in England and Wales (ICAEW) recently found that just one in four of its members said their clients in retail, hospitality and leisure would be able to pay business rates in full at the end of March 2021.

The Business Rates holiday has been extended

The Chancellor has avoided a ‘cliff-edge’ by announcing another business rates holiday until the end of June 2021. After that, business rates will be discounted.

The Budget Red Book (2.47) confirmed that eligible retail, hospitality and leisure properties in England will continue to receive 100% business rates relief until 30 June .

The rates holiday will go through a transitional period from July until the end of March 2022 when businesses will get 66% relief. The amount that a business can receive will be capped at £2m for properties that had to be closed on 5 January , or £105,000 per business for other eligible properties.

Who is eligible for the extended Business Rates holiday?

If your business pays business rates, you may be eligible for the rates holiday. A full list of eligible companies can be found in Annex A of the Gov.uk document.

What savings would a business make by having access to this relief?

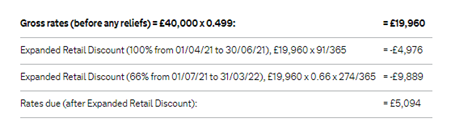

Example 1: An occupied shop with a rateable value of £40,000

Example 2: An occupied shop with a rateable value of £13,500 eligible for Small Business Rate Relief (SBRR)

Example 3: An occupied shop with a rateable value of £10,000 eligible for Small Business Rate Relief (SBRR)

How can I claim the Business Rates relief for my property?

Your local authority/council will write to your business and ask you to confirm the businesses eligibility for the relief as well as complete a declaration.

The long term social, economic and health impacts of the COVID-19 virus are still unknown. Our hope is that current global efforts to contain the virus and its impacts are successful. Whether this situation lasts weeks or months, the global response to this virus has fundamentally changed the reality for retailers. It’s time to face that fact and start adapting.

For more information on support packages available, follow SAIL Business Solutions Ltd on LinkedIn and Facebook where we share articles and updates on a regular basis.