HMRC has issued an amendment for working out Top Slicing Relief on life insurance policy gains, this amendment is in effect from 11 March 2020.

When a *chargeable event occurs, the whole gain will be taxed in the year of occurrence. This can lead to higher tax due had the gains been taxed on an annual basis. Top Slicing Relief attempts to correct this.

The legislation remains the same in terms of the relief being the difference between the tax payable on the full gain and the tax on the averaged gains. HMRC’s updated measure allows for the personal allowance to be reinstated for the calculation of Top Slicing Relief. This allows for a further relief by those impacted by a reduced personal allowance because the gain is included in income. In addition, the new measure clarifies the treatment of allowances and reliefs within the Top Slicing Relief calculation by confirming that they must be set as far as possible against other income in preference to the gain.

*It is important to note that chargeable events are taxable as income and further tax will only be due from higher, or additional rate taxpayers. They are not capital gains, so capital losses and the annual exempt amount cannot be set against them.

HMRC’s calculation for Top Slicing Relief is the same for both offshore and onshore bonds.

Step 1: Calculate the total taxable income for the year and work out how much of the personal allowance, starting rate band for savings, and the personal savings allowance are unused. i.e. in the order you would normally be taxed.

Step 2: Calculate the notional tax on the full bond due, and further deduct ‘tax treated as paid’ which is 20% (This may be reduced if any unused personal allowance is set against the gain). i.e. assuming the bond gain is taxed last.

Step 3: Calculate the tax on the average gain, again deduct the ‘tax treated as paid’. This is then multiplied by the number of years over which the gain was averaged. This is known as the relieved liability. i.e. the same as step 2 but averaged over the life of the bond.

Step 4: Deduct the relieved liability (Step 3) from the notional tax liability (Step 2) to give the amount of top slicing relief due.

Step 5: Deduct Top Slicing Relief (Step 4) from total tax calculation on all income (Step 1) to get the amount due.

Example

Jonathan’s income for the 2020/2021 tax year is as follows:

Salary: £33,000

Interest: £400

Dividends: £12,000

Offshore bond gain: £53,000 over 8 years

Notes:

- Personal allowance at £12,500

- Starting rate band for savings is zero (Income is above personal allowance plus £5,000)

- Personal savings allowance of £500 (higher rate taxpayer allowance)

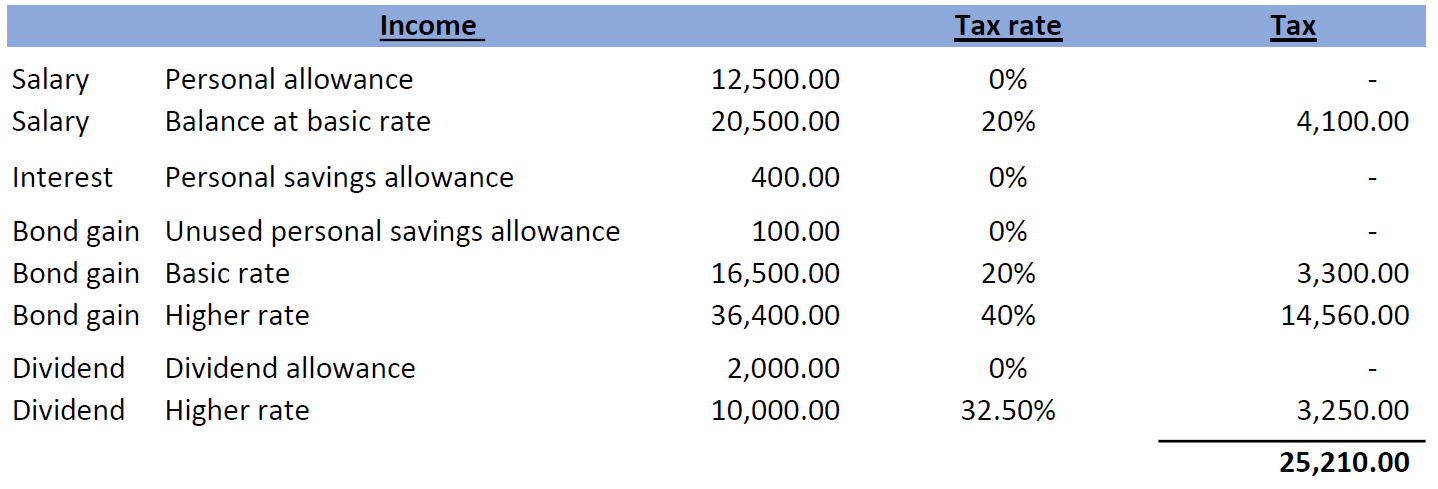

Step 1

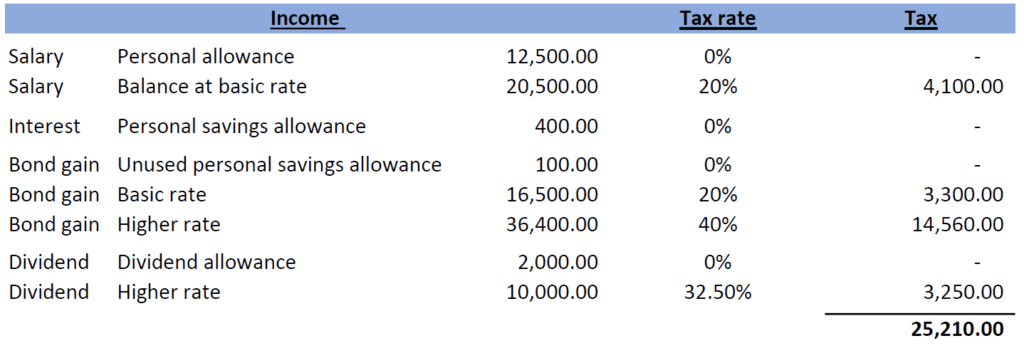

Step 2

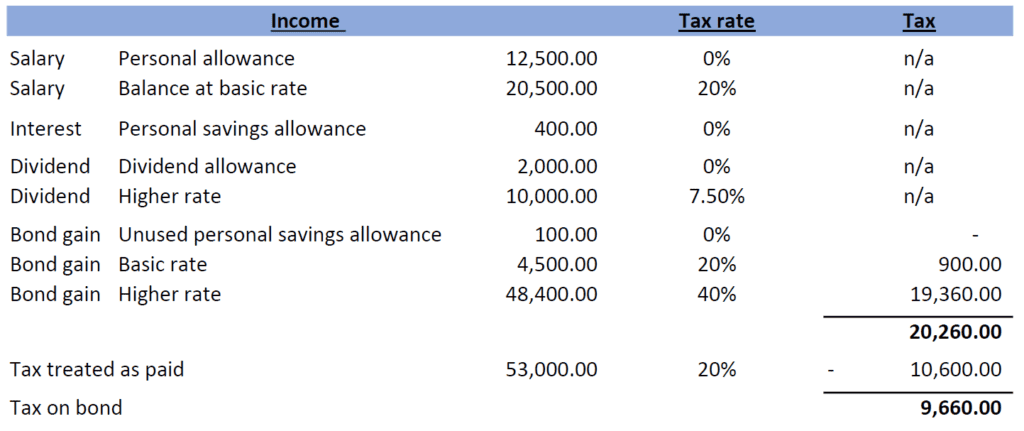

Step 3

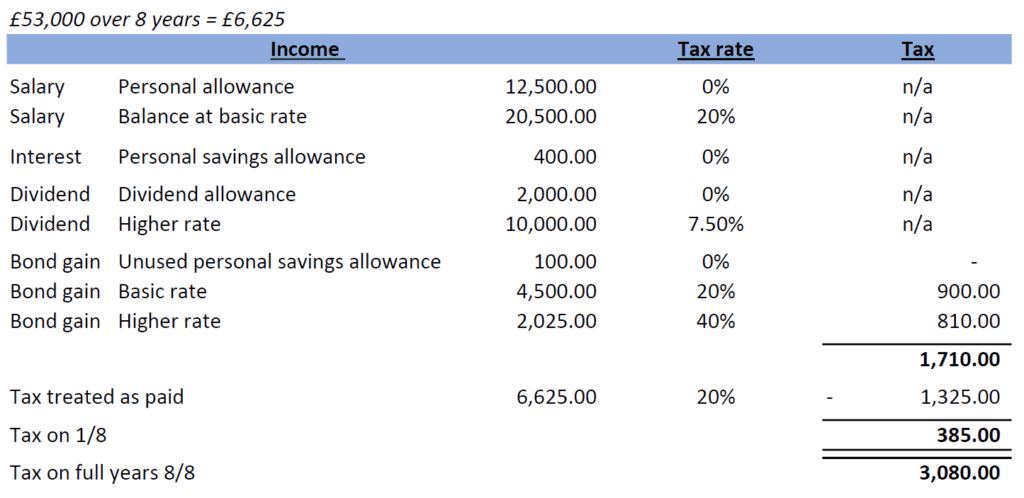

Step 4

Step 5

Overall, the impact of the top slicing relief in the above example is to reduce the tax paid on the bond gain from 38% (£25,210 less the tax one would have paid if only receiving dividends, salary and interest of £4,850) to 26% (£18,630 less the £4,850).

It is important to note that the above calculations only deal with one scenario and cannot be applied across the board. Other considerations need to be taken into account where a taxpayer begins losing their personal allowance, pays tax at the additional rate and or has onshore bond gains.