Starting a new business can be a daunting financial challenge, but many governments offer tax incentives to support entrepreneurs. In Ireland, start-up companies may be eligible for Corporation Tax (CT) relief under Section 486C of the Taxes Consolidation Act 1997. This relief allows qualifying businesses to reduce their CT liability in their early years of trading.

What is Section 486C Tax Relief?

Section 486C tax relief is a reduction in Corporation Tax for eligible start-up companies. It applies to profits from a new trade and chargeable gains made on assets used in that trade. The relief is designed to ease the financial burden on start-ups by reducing their tax liability for up to five years.

Who Can Apply for Tax Relief?

To qualify for the relief, your start-up company must:

- Be incorporated on or after 14 October 2008.

- Begin trading between 1 January 2009 and 31 December 2026.

- Have a CT liability of €40,000 or less in a tax year for full relief (partial relief applies if CT liability is between €40,000 and €60,000).

Qualifying Trades

Most start-up businesses qualify for relief. However, certain activities are excluded, including:

- Trades previously carried on by another person or entity.

- Land development and mineral extraction.

- Financial services activities under Section 441 of the Taxes Consolidation Act 1997.

- Agricultural and fishery-related activities as specified in EU regulations.

How Much Relief Can You Claim?

The amount of relief is linked to the employer’s Pay Related Social Insurance (PRSI) contributions. The relief is limited to the total amount of employer’s PRSI paid, subject to a maximum cap of €5,000 per employee and €40,000 overall per year.

Example 1: Full Relief

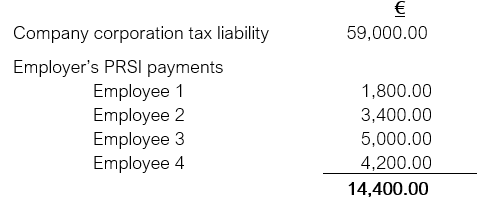

Qualifying PRSI is €10,200 (Employee 3 is capped at €5,000 so €1,700 is not considered for relief)

Relief available under section 486C is €10,200 and can be claimed in your CT return.

Example 2: Partial Relief

Qualifying PRSI is €14,400

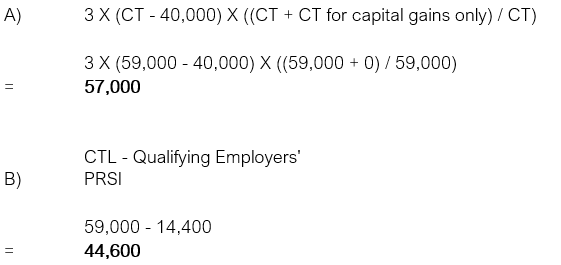

The amount of CT due can be reduced to the greater of A or B below:

The greater amount achieved is with Formula A.

Your CT of €59,000 can be reduced TO €57,000. Partial relief is therefore €2,000 (€59,000 – €57,000)

Carrying Forward Unused Relief

If your company does not fully utilize its tax relief within the qualifying period, it may be possible to carry forward unused relief:

- For up to five years if trading commenced on or after 1 January 2018.

- For up to three years if trading commenced before 1 January 2018.

How to Apply

Applications for tax relief must be submitted through the Revenue Online Services (ROS) portal via Form CT1.

Conclusion

Tax relief for start-up companies provides a valuable financial advantage for new businesses in their initial years. By reducing the tax burden, Section 486C relief supports entrepreneurship and business growth. Book a call here to find out how we can help your business.

Written by Erin Snyman, Head of Global Tax at SAIL International

Written by Erin Snyman, Head of Global Tax at SAIL International